Lessons from the SFL webinar on 1 December 2025

On 1 December, 2025, Sustainable Finance Lab hosted a webinar to explore a critical question: Is the European Central Bank’s (ECB) monetary policy helping or hindering the energy transition?

Two new research papers, presented by Andrea Polo (Luiss University/ECB) and Mark Sanders (Maastricht University), offered complementary but distinct perspectives on how interest rates and bank lending practices influence the deployment of green investments. The discussion revealed that while banks are beginning to price climate risk for greener firms in general, periods of monetary policy tightening have inadvertently slow investments in more specific market segments such as renewable energy projects.

Banks are pricing climate risk – but is it enough?

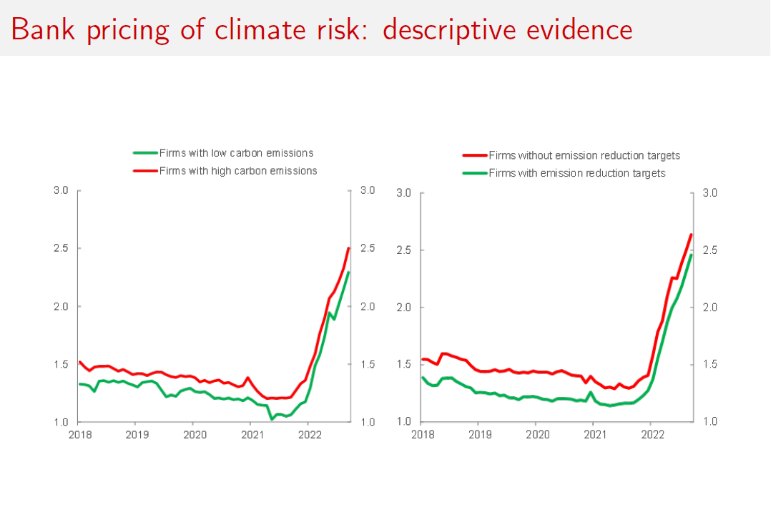

In their ECB Working Paper, Altavilla, Boucinha, Pagano, and Polo used the ECB’s AnaCredit database to show that euro area banks now systematically incorporate climate risk into loan pricing.

Firms with high emissions face higher interest rate spreads (4-10 basis points), while those with credible emission reduction targets enjoy a 16 basis point discount. This “green spread” aligns with findings from bond markets, where green premiums typically range from 10 to 20 basis points.

Moreover, their study also looks at the dynamic effect of monetary policy. When the ECB raises interest rates by 25 basis points, high-polluting firms see their borrowing costs increase by 2 basis points more than the average, while loans to firms with climate commitments rise by 9 basis points less.

While this differentiation is a step forward, Polo cautioned that it may not be sufficient to drive the rapid decarbonization required. He also highlighted a mismatch in risk horizons: banks assess credit risk over a one-year timeframe, yet climate risks materialize over decades – a disconnect that could undermine long-term transition efforts.

Monetary Tightening Hurts Renewables More Than Fossil Fuels

Mark Sanders presented the findings of a new paper co-written with colleagues (Serebriakova, Polzin, and Sanders, 2025) highlighting a structural bias in how monetary policy affects different energy technologies. The regression analysis found that a 25 basis point rate increase corelates with a reduction in new wind installations by 8%, and solar PV additions by 26.5%. Overall, the effect is equivalent to an increase the fossil fuel share in the energy mix by 0.6 percentage points.

Why the disparity? Mark Sanders emphasized the role of technology maturity. Early-stage renewables rely heavily on external finance and have higher upfront costs, making them more vulnerable to rising interest rates. As these technologies mature, their sensitivity to monetary policy may decrease.

At first glance, these findings might seem at odds with Polo’s conclusions. However, Polo clarified that the two studies are complementary. While banks may offer slightly better terms to green firms during rate hikes, these firms remain more sensitive to cost-of-capital changes due to their financing needs. Additionally, banks are not the only source of funding – bond markets and private equity also play a major role, and may explain why Sanders et al. find a larger impact of monetary policy shocks.

The Case for Flanking Policies

Mark Sanders argued that his significant findings justifies introducing flanking measures by the ECB during monetary contractions, such as differential interest rates for green vs. brown assets, expanded green bond purchases to lower financing costs for renewables, or enhanced subsidies to offset the impact of higher rates. Such tools could ensure that monetary tightening does not derail the energy transition, in line with the ECB’s mandate to support the economic policies in the Union.

Conclusions

Overall, the event revealed a shared recognition that although monetary policy works by change a single interest rate for the whole economy, this does not affect all firms and sectors in a neutral way. In this way, central banks could have a much larger impact on the energy transition in ways that are only beginning to be understood.

A major challenge remains: the lack of granular data on loan purposes. Current taxonomies classify firms as either “green” or “brown,” but this binary approach risks discouraging lending to high-emission firms that are actively transitioning – a counterproductive outcome for decarbonization. Polo called for improvements in data collection, suggesting that the AnaCredit database could include taxonomy-related data points to better track the purpose of loans.

Sustainable Finance Lab plans to continue this conversation, exploring how institutional investors, regulators, and civil society can work together to align finance with climate goals.

Watch the full discussion here: