Last weekend a right-wing coalition led by former fascist Giorgia Meloni won the elections in Italy. Europe braces nervously for yet another problem in what already is a complicated time. Will a new Meloni government continue to live up to the economic reform promises made by its predecessor Draghi? Or will it risk losing the much needed 200 billion Euro of recovery funds from the EU’s Recovery and Resilience Facility set up in response to the covid crisis?

This is a sensitive issue because of the many myths that exist in Europe’s North about Italy’s economic situation in the first place. Is it really the sick man of Europe, that owes its burgeoning public debt and the often problematically high interest it pays for government loans entirely to own mistakes, as northerners often content? And would it not have these problems if it had cut excessive public spending and reformed its economy like the countries in the zealous, frugal North? Should the coming reform of the EU’s Stability and Growth Pact therefore not make its rules stricter and their application more forceful, since this obviously has not been done in the past?

Dutch finance minister Hoekstra caused outrage when he, at the height of the corona epidemic in Italy, suggested to investigate why Italy and other countries in Europe’s South did not have enough fiscal space to ride out an economic downturn like the covid crisis on their own. This is indeed how many European frugals think. However, the truth is more complicated. Italy has been a net contributor to the EU’s budget since the early 2000s. It has also been running primary budget surpluses since 1992 until covid struck (2009-10 being the only exception) – unlike Germany and the Netherlands. Arguably Italy has carried out more labour market and other reforms, and done more budgetary consolidation over the past decades than Germany and France. Apart from, yes, excessive bureaucracy, an underperforming education system and often dysfunctional politics, its main problem remains a large debt legacy from the nineteen eighties. Not to mention an EMU architecture that has consistently worked to make getting rid of that debt more difficult, while accelerating the advantages of the countries in the North. Italy does have its weaknesses and problems that it alone can address. But it should also be clear that the current architecture of EMU and its budgetary rules contributed to their creation. Northern audiences who demand that problems be solved will have to accept that EMU is reformed in order to make this possible.

The covid crisis and its paralysing effects on economic activity have prompted the European Union to put its budgetary rules, the Stability and Growth Pact (SGP) that limits spending by national governments, on hold since 2020. At the same time, a planned review of the pact will start in earnest after the European Commission publishes its proposals in October this year.

The temporary suspension of the pact made it easier for governments to support incomes and businesses financially and to avoid economic paralysis and burgeoning unemployment, instead of having to cut spending in order to meet the EU’s deficit and debt requirements like governments did during the financial and Euro crises that started in 2008. After tough negotiations between government leaders in 2020, the EU even decided to launch an unprecedented EU-wide recovery investment package, in part funded with common EU loans. Most, if not all of these measures would have been unthinkable only a few years earlier – but the experiences with austerity in the post-2008 years and a nascent consensus, both in academia and in many countries’ political circles, that it had contributed to, and even deepened and prolonged, the economic crisis led to a completely different outcome this time.

This does not mean that the decision was an easy one. In particular governments from the mostly northern European states known as the ‘frugals’ (Germany, the Netherlands, Austria, Denmark and Sweden, and to some extent Finland) agreed only reluctantly, and often under heavy grilling from their own parliaments. The cliché view among electorates and many politicians there is that the countries in Europe’s South owe their high unemployment rates and government debts to a lack of “reforms”, lack of budgetary discipline and even laziness, whereas the North created its own prosperity with Weberian zeal and protestant frugality. Testament to this is the now infamous front page of Dutch magazine EW from 30 May 2020 (below) showing caricatural sun-bathing southerners (wine, coffee, dark hair) with hard-working blonde-haired northerners and the headline “Not a penny more to Southern-Europe!”

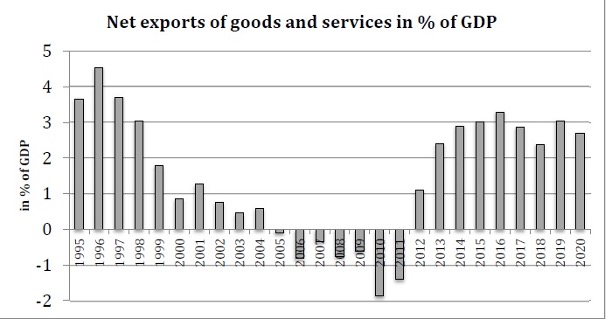

But are the northern clichés true? No, most are not. Few people in northern Europe will be aware that there is no tax money flowing from their countries to Italy in the first place, because it has been a net contributor to the EU budget since at least 2000. It is also rather a stretch to call Italians lazy, considering it is the second industrial producer of the EU (after Germany) and Italy’s balance of trade for goods and services has been positive for most of the past decades (see figure below from the very useful overview by Heimberger 2021, data also from Worldbank) – which, incidentally, also makes Italy a net exporter of capital.

More important in terms of fiscal discipline however, is that northern Europe has benefited less from its own moral rectitude (if that ever existed) than from the fact that the EMU construction mostly worked in its favour – and to Italy’s detriment.

It started during the run-up to the Euro’s introduction on 1 January 1999, when national currencies ceased to exist and their conversion rates to each other became fixed. In 1992, the Italian government’s net deficit had been over 10%, at a time when interest rates were much higher than in more recent decades. Government debt had doubled during the eighties, mostly as a result of the decision of its central bank to double interest rates in an attempt to attract foreign capital (Storm, 2019). Eager to comply with the demands for Euro accession Italy, as well as Germany and other Member States, engaged in reforms to to reduce government spending and debt, and carried out structural reforms in the form of deregulation of labour and product markets.

As several authors (e.g. Notermans and Piattoni, 2021) concluded Italy privatised state-owned enterprises and reformed its labour and product markets in much the same way as Germany during those years. The result is that the OECD rated Italy’s product market restrictiveness at the same level as Germany’s by 2018. In terms of labour market reform the results are a little more mixed in the sense that the liberalisation of contracts and of the wage-bargaining process for both countries was less than prescribed by the macroeconomic consensus of the time, although the result was quite similar for both. Some authors (e.g. Storm, 2019 in an in-depth study) argue that Italy reformed even more in this respect than Germany, France and most other Eurozone members. The reforms led to fewer fixed and more temporary contracts and lower real wages in Italy compared to Germany and France. Employment protection was reduced too. By the time the financial crisis hit, unemployment in Italy was 6%, lower than in Germany and France.

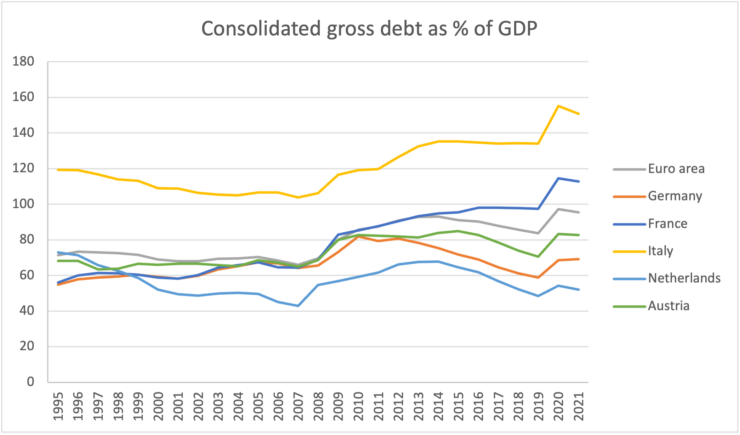

As the picture below (data from Eurostat, extracted 23-9-2022) shows, Italy managed to bring down its legacy debt from the nineteen eighties by almost 20% until the financial crisis started in 2008.

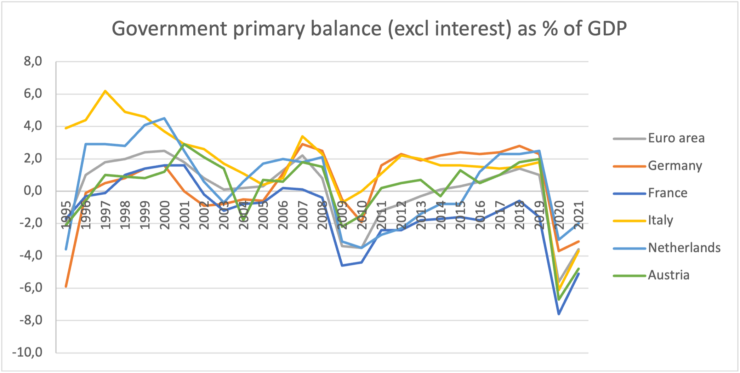

The country also maintained a primary government surplus (i.e. excluding interest payments) almost consistently between 1992 and the beginning of the covid crisis (exceptions are 2009-2010), performing better than even the most vocal of the frugal countries (see picture below, data from AMECO extracted 24-9-2022).

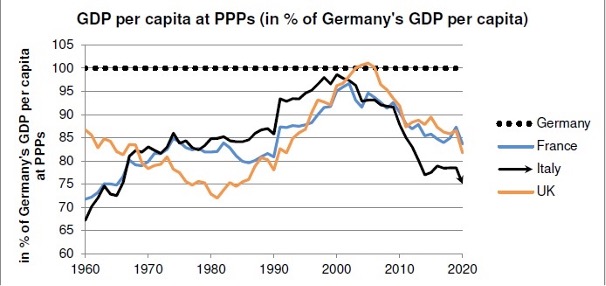

But although Italy stuck to the EMU rulebook as well as Germany did, and continued to do so after the financial crisis hit, the results were quite different as we can see in the picture above showing Italy’s rising debt load since 2009, and in the picture below of GDP per capita (from Heimberger 2021). As argued by Heimberger, Italy’s living standard rose during the nineties to a level virtually equal to that of Germany by 2000, but fell behind ever since and by 2020 was 25% under Germany’s (see picture below).

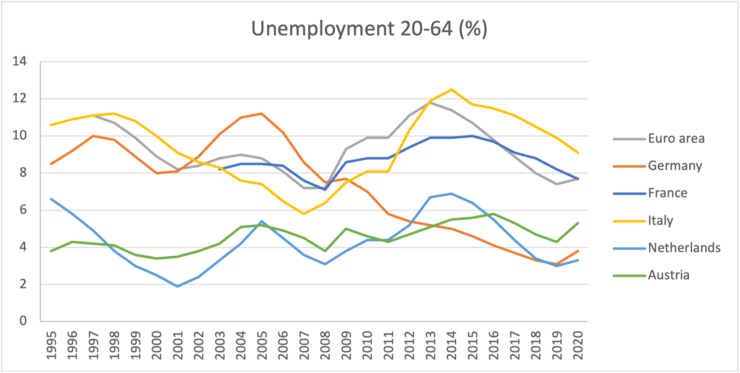

Employment figures (see below, data from Eurostat extracted 26-9-2022) show similarly mixed results. Until the financial crisis there is a substantial decrease of unemployment in Italy to a level below that of Germany, France and the Eurozone average. When the financial crisis starts however, unemployment rises sharply to a peak level of 12.5% in 2014. German unemployment in contrast continues to fall.

There are several explanations that have been put forward for these different results. One is that the strong emphasis on cost reduction in Italy has reduced public investments and also domestic demand in Italy itself, which led to economic stagnation (see e.g. Baccaro & D’Antoni, 2020). Thanks to the reduction of job protection, downturns also lead to immediate lay-offs, whereas in Germany employment moves from the manufacturing to the services sector, which is less dependent on export but where wages are lower. Lower unit labour costs also make it less interesting to invest in education and training which in the long run improve productivity.

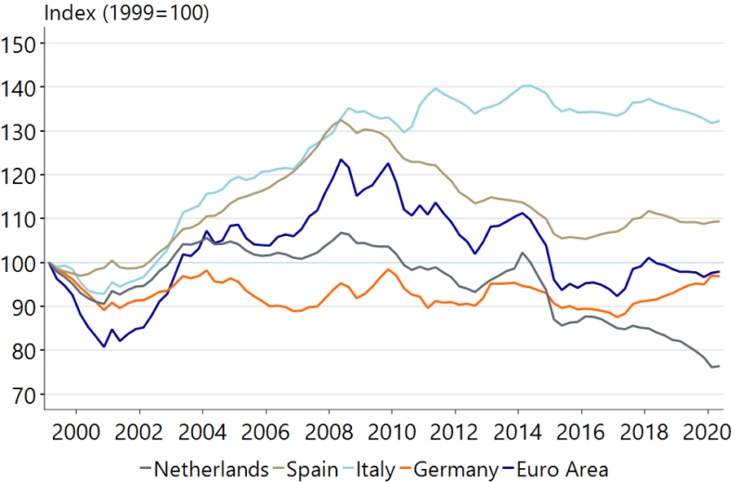

Another factor is that as part of a currency zone the euro’s exchange rate is not necessarily the optimum for all of its member states. Comparing Real Effective Exchange Rates (REER, imaginary exchange rates based on unit labour costs and weighted according to individual Member States’ trade volumes with countries in the rest of the world, see e.g. Rabo, 2020) it can be argued that the Euro has become ever more expensive for Italy and other countries in the South because it makes their exports too expensive, whereas the reverse holds for countries like Germany and especially the Netherlands.

Picture below: Real Effective Exchange Rates (Index: 1999=100) have diverged across the Eurozone (higher REER = less competitive, source: Rabo, 2020).

High debt servicing costs are an additional reason why public investments do not pick up. Storm argues that the extraordinary primary surpluses alone would have been enough to push Italy’s debt-to-GDP ratio down by 40% in 2008 from its 1994 level of 117% if all else had remained the same. A combination of lower growth and relative high interest rates however reduced this to almost half that amount. He also points to the fact that Italy’s government often applied the EMU’s Hayekian recipes of the time even more zealously than required. As a result the fiscal consolidation over 1992-2008 was based more on cutting public spending than on raising more taxes, thus contributing to the under-investment that perpetuates the problem.

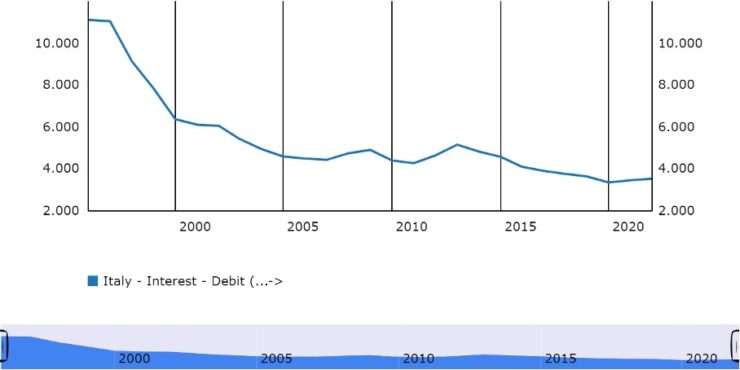

The figure below shows Italian government interest expenditure as % of GDP (picture from ECB extracted 25-9-2022):

It should be noted however that Italian borrowing costs have gone down considerably. They amounted to no less than 11% of GDP in 1995 when debt-to-GDP was 119%. By 2007, when Italian debt was at its lowest point with 104% of GDP, borrowing costs were down to 4.5% of GDP. But in 2020, with a ballooning debt ratio of 156% as a result of covid, the cost of borrowing had fallen further to 3.3% – mostly thanks to the ECB’s policies in response to the financial covid crises. As long as Italian government bond spreads remain below 200 bps, Claeys and Guetta-Jeanreneau (Bruegel, 2022) estimate that Italy’s debt-to-GDP ratio will continue to fall.

The covid pandemic is not yet over, we do not know how the war in Ukraine will end and how the energy crisis will unfold in the months to come. But it is clear that the economic consequences will be felt for a long time, and that Europe must do what it can to mitigate those consequences and put its economy on the path to recovery and a sustainable (energy) future. Italy is one of the countries with a backlog of problems, and due to the size of its economy alone these problems are Europe’s too. It is up to Italy to solve most of them: to improve productivity by investing in education and technological development, to tackle its often stifling bureaucracy, and to invest in regional development to heal its yawning north-south divide. But it cannot do so if it does not have the financial means because northern misperceptions and disinformation prevent a reform of the EMU’s architecture that would be in the interest of both the North and the South.